You will not want to miss this year’s report because we are celebrating the substantial rebound in association membership after the challenges of the past several years.

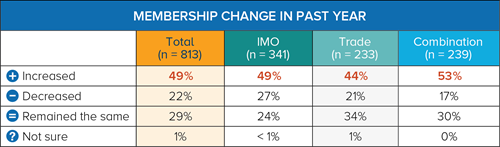

Here is the good news. A total of 49% of associations report an increase in membership counts. In contrast, only 22% of respondents share that their membership has declined, and this declining percentage is one of the lowest in the 15-year history of our benchmarking.

Each year the report not only presents the numbers reported by 800 participating associations, but we also analyze what practices and activities correlate with associations experiencing this membership growth.

This year, our data highlight several drivers that support increases in membership.

New Member Acquisition

Membership acquisition again led the way with its correlation with overall membership increases. 50% of associations show an increase in new member acquisitions. Over the years, we have found that a much higher percentage of associations experiencing higher levels of new member acquisition are also more likely to have overall increases in membership.

Value Proposition

Not surprisingly, the value provided by an association also correlates with increases in membership. Associations that report a very compelling or compelling value proposition are more likely to see increases in their one-year and five-year membership counts and renewal rates. In contrast, those who say that their value proposition is not very or not at all compelling are more likely to report declines in five-year membership counts and new members.

Association Innovation

Another robust correlation with growth centers on the innovation level of the association. Once again, associations reporting increases in one-year and five-year membership are more likely to say that their organization is extremely or very innovative. The two most frequently cited new initiatives–developed one or more new membership benefits (48%) and expanded to audiences beyond our core members (31%)–correlate with membership growth.

Market Changes

This year’s data also reveal additional trends that highlight changes and, in some cases, a continuing recovery for associations. Changes in attendance patterns are particularly noteworthy. In-person, annual conference attendance saw a solid turnaround. In last year’s report, only 26% of respondents said they saw an increase in on-site attendance, while 53% reported a decline. This year, we see the reverse. 58% report increased attendance at their in-person annual conference or trade show.

Additionally, attendance at in-person professional development meetings increased. Last year only 25% of respondents said attendance was up, while this year, 44% show an improvement. Survey respondents share, “Our members want to meet in person. Burnt out on ZOOM and TEAMS meetings.”

Conclusion

The complete Membership Marketing Benchmarking Report includes over 70 pages of data on best practices related to members’ recruitment, engagement, renewal, and reinstatement. We also explore specific topics, including:

We are celebrating a strong year of membership growth and want to share the report with you. To get your copy of the 2023 Report, use this link, or go to the Knowledge Bank on the Marketing General Incorporated website.

If you need help with your membership program, let’s talk. Contact Tony Rossell, Senior Vice President, at tony@marketinggeneral.com or 703-706-0360.